Home price expected to rise by maximum 3% in 4Q conducive to stable outlook

- Economic recovery in Hong Kong drove upsurge of residential property transactions by 15% y-o-y in 3Q 21. With purchasing power gradually unleashed, transaction volume has gone down since August and is expected to shrink in September. Property market will enter consolidation phase.

- Despite a downward trend in transaction volume, home prices are expected to progress steadily in 4Q with room to rise by maximum 3%.

- New project sales from property developers are expected to continue in 4Q, and primary sales will dominate the market

Global real estate services firm Cushman & Wakefield publishes Hong Kong Residential Markets Review and Forecast 3Q 2021 today. With the purchasing power of the market unleashed at a certain level and consumed in 1H 21, available affordable units reduced, and diminished bargaining space for owners, the transaction volume has displayed a downward trend.

Subscribe to our Telegram channel to get a daily dose of business and lifestyle news from NHA – News Hub Asia!

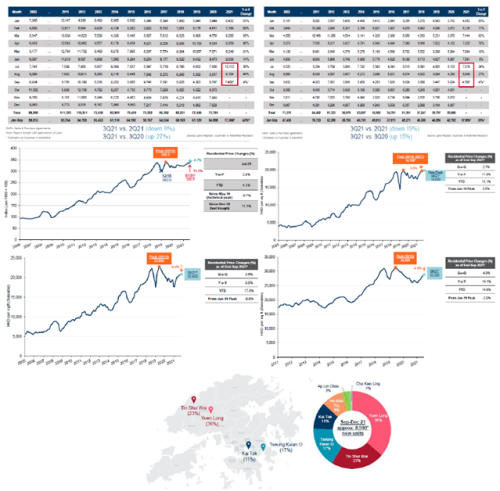

Mr Keith Chan, Director, Head of Research, Hong Kong, Cushman and Wakefield comments, “Transaction in the market has been active since 2021. The total number of sales and purchase agreements (S&Ps) in the first 9 moths is estimated to be 77,369 cases, ie. an upsurge of 27% y-o-y (Chart 1), while the number of residential S&Ps is 57,956 cases, both reaching a histocical high since 2012. However, the number of residential S&Ps in 3Q 21 is forecasted to be 17,825 cases, representing a plunge of 19% q-o-q (Chart 2). This is mainly due to the fact that affordable units have been gradually consumed by the market. With limited availability of residential units, owners’ bargaining space has narrowed and they even began to raise prices. Buyers took a wait-and-see attitude, waiting for the market to cool down, leading a see-saw situation between the two. Transaction became slow, bringing the property market to consolidation phase.The downward trend is expected to continue with S&Ps falling to 4,700 cases in September (Chart 2).”

Mr Edgar Lai, Director, Valuation and Advisory, Hong Kong, Cushman & Wakefield comments, “In terms of property price, overall home price has risen by 4.3% since 2021 and is expected to surpass the peak of May 2019 soon. The average price at City One Shatin has already made its historical high (Chart 4), and that at Taikoo Shing has also risen by 2.5% q-o-q (Chart 5). Luxury homes such as Residence Bel-Air show similar performance as common residential homes with a 15% rise since 2021 (Chart 6), only less than 3% from its record high. We forecasted a full year increment of 8% to 10% in 1Q 21. We expect property price will rise steadily in 4Q with a further increment of maximum 3%.”

Commenting on the market outlook, Mr Edgar Lai further commented, “Following a round of active transactions, we expect that the purchasing power previously accumulated in the property market has been released. Buyers also become more cautious after prices have recorded certain increment so far. Moreover, banks are less active in getting business at year end as it is traditional an off-season period for mortgage. In this regard, we expect that both transaction volume and property price increment will continue to slow down in 4Q. Property prices have reached historical-high and the property market will enter a period of consolidation. We forecast that about 8,900 new units will be ready for primary sale from September to December (Chart 7), of which many come from large-scale developments. 76% of these are located in the New Territories and the rest across Hong Kong. If primary sales performance is good, the outcome will be conducive to the stable development of the market. We have forecasted residential price growth of 8% to 10% throughout 2021 by start of the year. With home prices expected to progress steadily in 4Q, we would estimate a maximum 3% growth by end of the year.”

SOURCE: Cushman & Wakefield (press release)