According to the latest statement, Maybank is expecting a continued rise in e-Angpao adoption and targets a 100% growth in both number and value of e-Angpao transactions this Chinese New Year, as Malaysians become even more digitally adept and mobility restriction remains in place throughout the country.

Spurred on by the encouraging response in 2020, where the number of transactions increased to 840,000, the Bank sees its e-Angpao service growing in 2021 as more customers become comfortable with the notion of sending e-Angpao during Chinese New Year, especially in the new normal.

Dato’ John Chong, Group Chief Executive Officer, Community Financial Services of Maybank, said that the Bank expects close to 1.7 million e-Angpao transactions amounting to over RM60 million to be sent by customers during the festive season this year. “In light of the pandemic, the e-Angpao service provides our customers who are unable to meet with their families this Chinese New Year, a safe and convenient way to participate in the cherished tradition. We hope that the e-Angpao will be able to give them a sense of normalcy and a chance to bond with their family members despite having to physical distance to keep everyone safe,” he said.

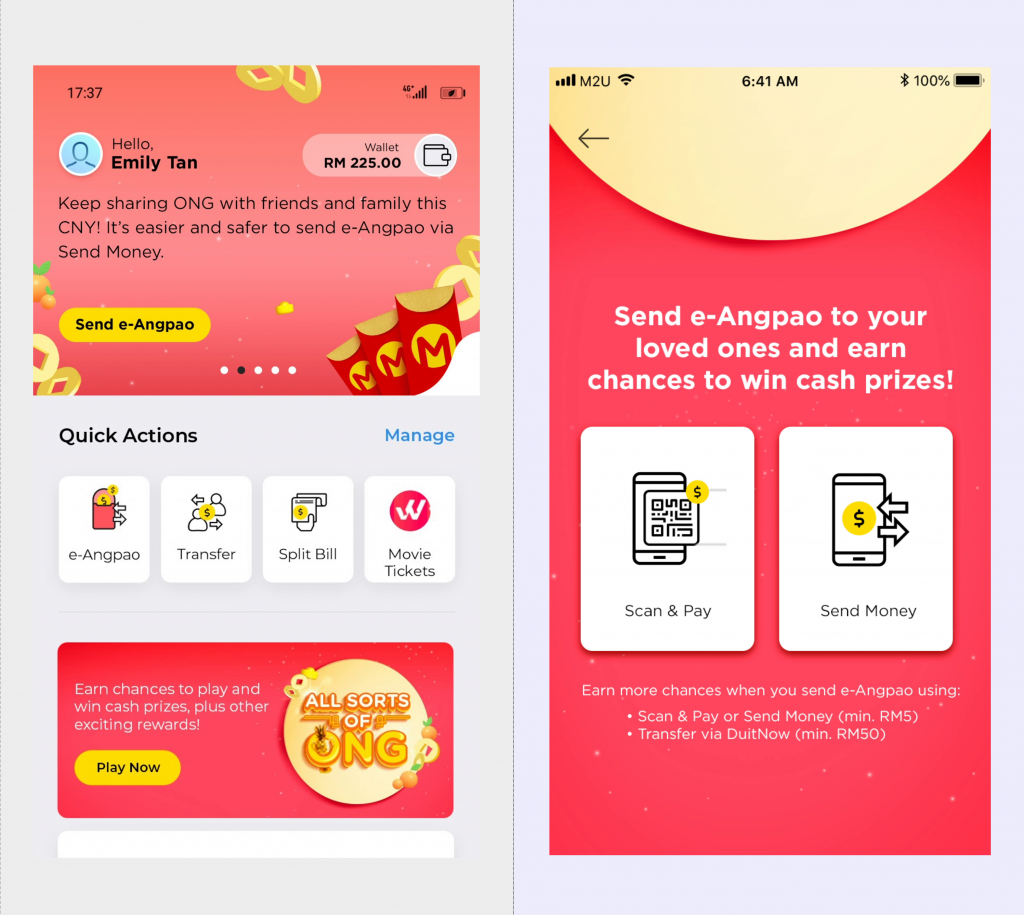

This year’s e-Angpao campaign is themed “MAE-KE IT ONG!”. Maybank customers can send e-Angpao to family and friends by clicking on the e-Angpao icon exclusively on the all-new app MAE by Maybank2u, from 8 February 2021 until 7 March 2021.

The e-Angpao can be sent via 2 ways through the e-Angpao icon on the MAE app:

- Using the ‘Send Money’ function for recipients with MAE app; OR

- Using the ‘Scan & Pay’ function, for recipients with a QR code-enabled banking app.

Additionally, customers who send a minimum of RM5 e-Angpao with the MAE app can also earn entries to participate in the ‘ALL SORTS OF ONG’ campaign. Customers stand a chance to win cash rewards, vouchers and prizes worth up to RM7 million, with the Grand Prize being a RM3,000 cash reward.

Since its inception on 8 October 2020, the MAE app has garnered over 1 million users within less than 4 months. Apart from the Maybank2u online banking features, the newly introduced Expenses tops the chart as the most used feature in the MAE app. It is an automated expense tracker which gives users the breakdown of their spending pattern in categories. With online shopping being the “new normal” these days, a new category “Online Shopping” was also introduced recently under Expenses to help customers track their spending better.

For more information on the Maybank e-Angpao service and ‘ALL SORTS OF ONG’ campaign or to download the MAE by Maybank2u app, please visit www.maybank2u.com.my/mae.

Source: Maybank (Press release)