On the 3rd April 2020, Bank Negara Malaysia (BNM) released a summary of its forecasts for the Malaysian economy going into 2020 and the results are worrying to say the least, with gross domestic product (GDP) being forecasted to suffer greatly during this troubling period. Real GDP growth In the current environment, BNM forecasts economic growth to be between -2.0% to +0.5% in 2020, supported by the recent stimulus policy and monetary easing measures such as overnight policy rate (OPR) cuts and statutory reserve ratio (SRR) reduction. In addition, pump priming via increase in spending on public projects and higher public sector expenditure is set to continue into the medium to long term.

Growth in the current year however is set to be weighed down by a severe output loss due to the COVID-19 pandemic, the loss in consumer demand and production capacity due to the movement control order (MCO) and commodity supply disruption owing to the recent collapse in the global crude oil price. Malaysia’s economy will be severely and adversely affected by the pandemic, buffeted by both weak global demand and domestic containment measures. In terms of contribution to real GDP output, the export of goods and services is forecasted to fall substantially from -0.8% in 2019 to -8.7% year-onyear (yoy) in 2020.

This will be the direct result of weak global export demand and dragged by international supply chain disruption due to restrictions placed on both consumers and producers. The lower receipts from foreign tourism will also drag on earnings growth for large sections of the economy and serves to reduce our export of tourism services. Private sector investment will suffer greatly, bogged down by weak investment demand and poor business sentiments despite our massive RM250 billion fiscal stimulus package. Private consumption is set to be weaker this year, with BNM projecting a 2.5% yoy increase compared with 4.3% in 2019. This figure however remains subjective, the estimate is based on a ceteris paribus (all else being equal) assumption of national income. If massive layoffs and unemployment occurs during this crisis, a sharp decrease in income can crimp private consumption resulting in negative growth.

Pump priming via the continuation of large-scale infrastructure projects will have a positive impact on GDP growth, capital spending for major transportation infrastructure projects such as the mass rapid transit phase two (MRT2), light rail transit phase three (LRT3) and the Pan Borneo Highway projects at estimated RM15 billion this year and is expected to lift 2020 GDP growth by 1.0%. The stimulus policy will effectively cushion the economic impact on households and businesses.

Several key approaches from the stimulus policy aims, among others, to strengthen the nation’s healthcare resources by increasing medical personnel and equipment for detection and treatment; provide welfare safety net to households through direct cash assistance to households, minimise the 2 adverse impacts on businesses and to seize future growth opportunities. In total, BNM projects the stimulus policy may add 2.8% in GDP growth in 2020.

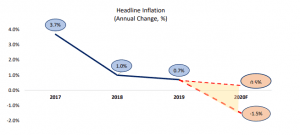

Inflation will mostly remain subdued due to weaker global consumer demand and lower global oil prices. This is reflected in BNM forecasts of headline inflation to average between -1.5% to 0.5%. This is however subject to global commodity prices such as potential swings in the price of oil. Despite the low headline inflation numbers forecasted, BNM also predicts that core inflation will remain strongly in positive territory, estimated between 0.8% to 1.3%, this is due to subdued demand pressure, weak labour market conditions in wage growth and a projected negative output gap for the year 2020. These forecasted inflation numbers should send alarm bells ringing for government policy makers, as core inflation, a measure that tracks the growth in the price of necessities and essential items is projected to surpass the raw headline inflation rate.

By definition, core inflation removes volatile components in price movements, tracking non-volatile inelastic items, such as food and electricity. A higher core inflation rate indicates that prices outside of core items are set to fall sharply this year and the price of everyday goods is set to rise above the price movement of the general economy. Current account surplus perhaps a silver lining in the forecasts show that the current account will remain in surplus territory supported by a continued export surplus, albeit lower than the growth rate of the prior year and reflective of a diversified export structure, despite an overall 8.7% yoy drop in goods and services exports.

The Purchasing Manager’s Index (PMI) is an averaged index of purchase orders from manufacturers across the region, where a figure above 50 indicates an expansion and below 50 indicates contraction in purchasers demand. BNM noted in its report that since the start of the crisis, China’s PMI had reduced from 53 in January to nearly 27 in February, a 49% decrease. Europe from 52 in January to 34 in February or a 35% drop and in Japan it dropped from 50 in January to 36 in February or a 28% drop.

The United States on the other hand seems the least affected dropping from 54 in January to slightly under 50 in February, though this may have changed in March as more and more states are considering lockdown measures. In this regard, it was noted that the unprecedented containment measures by a number of large economies have triggered a severe adverse shock to both demand and supply factors concurrently. As countries initiate further lockdown measures, closing non-essential factories and forcing the population to practice self-quarantine and social distancing, this resulted in a devastating contraction across all economic activity. The prospects for recovery for both developed and developing nations deteriorate as the effects of the pandemic escalate which the IMF noted could be worse than the Global Financial Crisis (GFC) of 2008.

The PMI is used to estimate future trends in the overall economy, with such a large drop across all large economies, it is likely that the downturn from the COVID-19 virus will linger for the foreseeable future.

Financial Stability

The stability of financial markets is of paramount importance during this crisis, ensuring that the financial system is able to serve the needs of the economy. In short, the stimulus package includes relief for individuals, SMEs and corporations, which include a six-month loan deferment, conversion of credit card balances into loan facilities, facilitation of loan restructuring and rescheduling, lower financing costs from the OPR cut in January and March 2020 and flexibility in preserving insurance and takaful policies.

Additionally, measures to support lending activities by financial institutions and intermediaries include adjustments in the Statutory Reserve Ratio (SRR), the flexibility to draw on capital and liquidity buffers and a review of regulatory policies and implementation timelines will likely bode well for the nonbanking industries as the burden of financial obligations are eased.

BNM further argued that domestic banks are in a good position to support the economy, as they have strong financial buffers built over the years compared to the crisis faced during 2008. Total capital ratio, a metric used to measure the amount of a bank’s capital in relation to the amount of risk exposure it has, is generally regarded to be healthy at 8%. During the 2008 GFC, Malaysia’s Total Capital Ratio was at 12.6% and had an excess capital buffer of RM39 billion. As at February 2020, the total capital ratio is 18.4% with an excess capital buffer of RM121 billion, indicating a stronger ability to withstand a shock to the financial markets. It is therefore possible for banks to continue its financing of the economy for the time being.

The banking industry’s Liquidity Coverage Ratio (LCR), a measure of its ability to meet short term cash obligations, has increased from an average of 137% from 2015-2019 to 148% in February 2020. In addition, the Loan Loss Coverage Ratio had increased from 120% over the past four years to 125% in February 2020 indicating conservative and adequate bad debt provisions had been set aside. More importantly, stress testing by BNM has affirmed the resilience of the financial system under different scenarios of severe economic conditions.

Recommended Actions

As BNM had noted, with the relative strength in the banking industry, more can be done to leverage on the stronger balance sheets of the nation’s banks. Therefore, the six months moratorium period for loans and encouragement of potential restructuring and rescheduling of loans for corporations are technically more feasible today than they were during the GFC. However, many corporations, both small and large have complained about the inefficiency and downright reluctance of banks in accepting applications for these measures. A recent survey by Ringgitplus had shown that 18% of loan applications for rescheduling and restructuring of loans have been rejected by the banks themselves, owing to the more conservative nature of the banking industry today. In addition, the high level of bad debt provision is a good indicator that banks can afford to take on greater risk exposure in the short term.

It is then important that a clear administrative directive is given to the top management of such banks to liberalise the application process and measures the government intends to undertake to soften the blow to domestic corporations. This should be brought under a body that manages supervisory oversight for these banks to ensure that corporations get the help that they deserve. This approach must however be balanced so as to not burden the banks with too much oversight, hence limiting their freedom to do business. Rather, this oversight body should adopt a measured approach on mediating between the banks and their clients and independently investigate complaints brought forward by either party.

To secure a better growth path after the epidemic has subsided in the near term, a medium-term focus should be on accelerating technology adoption should be implemented, with partial government-backed loans available for companies looking to expand their technological capabilities. It is understood that periods of great economic uncertainty and crisis often lead to profound accelerations in the methods and means of production, generating greater cost efficiencies as time goes on. In this context, the focus of the government should be on accelerating the increased adoption of innovations that will help transform the overall efficiency of the market.

To ensure that the economy does not lose out on opportunities in foreign trade and domestic consumption growth, the government should also look into slowly lifting the number of workers allowed to return to work in both essential and non-essential manufacturing and mining of up to 50% of the workforce. This of course should be met with mandatory health screenings and testing before they are allowed to return to their place of work. This is because much of our exports are focused on satisfying the global supply chain in China and in nations elsewhere. A gradual reopening of workers allowed to return to productive activities will help strengthen our already shaky manufacturing sector and to take advantage of the opportunities afforded to us by this global crisis.

Finally, the government should:

1. Encourage the recalibration of investment incentives to encourage greater domestic enterprise,

2. Adopt a medium to long term policy to incentivise investment into enterprises through an enterprise investment scheme where large corporations are allowed a progressive scheme of tax deduction, generating greater investment into local enterprises (in the form of low interest rate enterprise bonds or equity holdings). This will help to incentivise and redirect the flow of capital from large corporations to SMEs.

Final Thoughts

Though the BNM forecasts for 2020 paint a grim landscape of a suffering economy, the fact is that this is unlikely to dent our credit ratings in the near term as many other countries and large economies are going through the same challenges, several with even greater impact to their respective economies. As long as the government is able to control and contain the spread of the pandemic and to keep our economy working with minimal disruption and corporate bankruptcies, we may end up becoming a relatively better performer than many regional and global economies. For this to happen, we need

good and decisive decisions and decision makers who know what they must do to ensure the survival of the economy.