Deloitte has launched a new report finding that micro multinational companies (micro-MNCs) in Asia Pacific (APAC) are increasingly adopting digital technologies and investing more in branding as they remain optimistic about cross-border e-commerce and digital trade.

The report ‘Going-Global: Seizing the Next Great Opportunity in Digital Trade‘, conducted in collaboration with WorldFirst, reveals that APAC has maintained its status as a key driver of global economic growth amidst global economic slowdowns, geopolitical tensions and rising protectionism. Specifically, the region’s import and export trade in goods accounted for approximately 40 per cent of global trade activities, reaching nearly USD18 trillion — a 30 per cent increase from the USD13.7 trillion in 2013.

WorldFirst is a one-stop digital payment and financial services platform for global businesses, especially SMEs in international trade. Clara Shi, chief executive officer of WorldFirst, said, “WorldFirst is proud to collaborate with Deloitte to explore the opportunities and challenges confronting today’s micro-MNCs. This report’s findings are designed to better support SMEs across the APAC region in leveraging the significant potential of cross-border digital trade.”

71 per cent of the surveyed micro-MNCs — enterprises engaged in cross-border e-commerce and digital trade — remain optimistic about the prospects of cross-border e-commerce over the coming year. This indicates that most companies are confident in market demand, policy environment and technological advancements, anticipating continued market expansion with significant growth in sales and profits.

Meanwhile, 88 per cent of companies surveyed recognised that branding is crucial in sustaining long-term business growth. Branding not only helps businesses establish a differentiated competitive advantage in the market but also enhances customer loyalty and market share. As a result, 68 per cent of the businesses said they would increase investment in branding.

The report also highlights the pivotal role of the Malaysian government in driving digital trade growth, particularly through the Digital Free Trade Zone (DFTZ). This initiative represents a collaborative effort across multiple departments and agencies, including the Ministry of Investment, Trade and Industry (MITI) and the Malaysia Digital Economy Corporation (MDEC), aimed at boosting SME participation in cross-border e-commerce and facilitating international market entry.

As part of its digital economy blueprint, Malaysia is positioning itself as Southeast Asia’s data centre hub. The government is actively supporting this development by offering key resources such as land, electricity, and favourable policies, attracting numerous global digital infrastructure leaders to establish data centres. Additionally, major cloud service providers are expanding their investments in Malaysia.

Malaysia is also recognised as a high-potential market with robust growth momentum in digital trade. The country has experienced significant advancements in digital payment systems in recent years, with a marked increase in adoption rates. It is home to a variety of digital payment service providers, including Touch ‘n Go’s TNG eWallet. Furthermore, Malaysia has introduced a unified QR code payment system to streamline digital payments for consumers.

Cross-border businesses look for comprehensive platform for payment and financial services

The Deloitte-WorldFirst report finds that more micro-MNCs have begun running multiple business lines, operating more than one e-commerce marketplace, and setting up local operations in overseas markets — a shift partly due to increased competition in cross-border e-commerce. This trend has driven cross-border businesses to seek integrated payment and financial services providers.

Consequently, the cross-border trade payment firms, including WorldFirst, have transitioned to a one-stop comprehensive platform that offers payment, trade financing and other financial services. They have also integrated upstream and downstream supply chain services, such as logistics, taxation, and advertising, to support the various business scenarios of these merchants.

Key global findings from ‘Going Global: Seizing the Next Great Opportunity in Digital Trade’ include:

- Big data analytics will lead the application of digital technologies among micro-MNCs. Big data analytics (75 per cent) is currently the most prominent and widely applied technology, followed by artificial intelligence (AI) (47 per cent), as these technologies are directly related to business optimisation and the enhancement of customer experience. Meanwhile, technology application in payment and settlement (20 per cent) and risk management (18 per cent) demonstrates the importance enterprises place on security and stability.

- Digital trade in APAC is experiencing significant growth. From 2017 to 2022, APAC’s annual growth rate in digitally deliverable services exports was 10.3 per cent, outpacing the global average of 7.1 per cent. Leading export markets within the region include Australia, China, Japan and Singapore, while the European Union (EU) and North America are the region’s primary external trading partners, accounting for 27 per cent and 20 per cent of APAC’s export market, respectively.

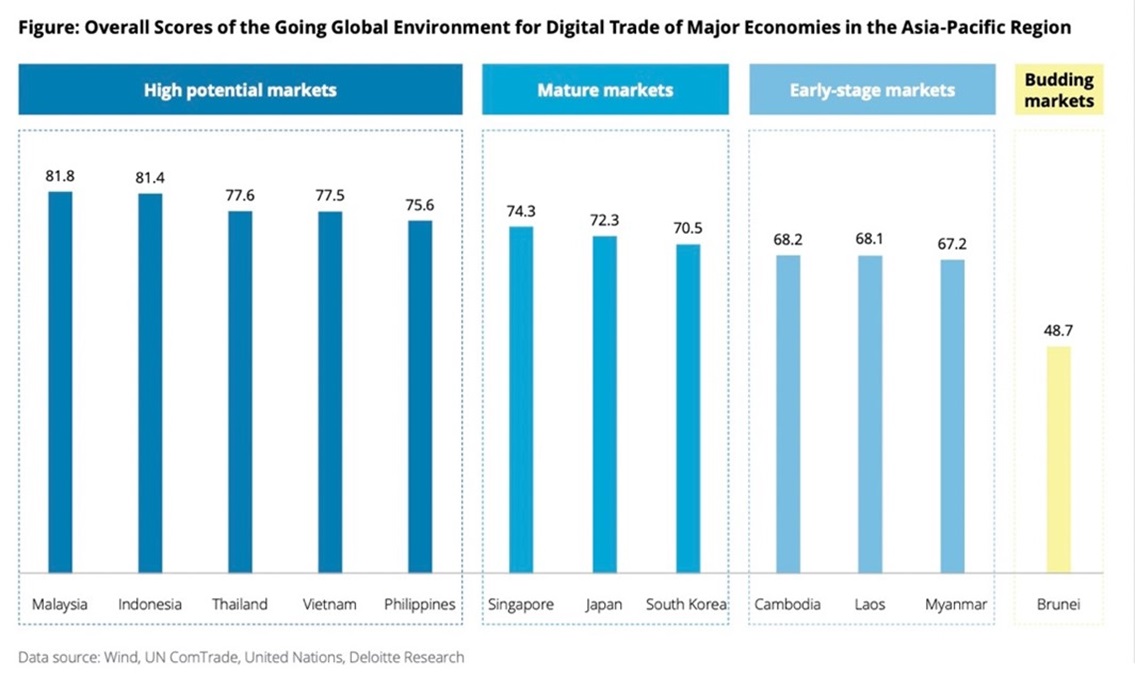

The Deloitte-WorldFirst report developed a new index to assess the digital trade environment and growth prospects for each country.

- High Potential Markets: Indonesia, Malaysia, Vietnam, Thailand, and the Philippines

- Mature Markets: Singapore, Japan, and South Korea

- Early-Stage Markets: Cambodia, Myanmar, and Laos

- Budding Market: Brunei

The Deloitte research surveyed approximately 300 cross-border SMEs, typically with fewer than 500 employees and primarily based in East and Southeast Asia.

Cheng Zhong, managing partner of Technology, Media and Telecommunications Industry, Deloitte China, said, “Digital trade enterprises are leveraging leading-edge digital technologies such as big data analytics, AI, IoT and cloud computing to forge innovative business models and value chains, enriching the global marketplace with a broader spectrum of goods and services.”

“Moreover, digital platforms, represented by cross-border e-commerce, are transcending space and time, fostering seamless collaboration across the global value chain,” he continued.

Echoing this sentiment, Lydia Chen, Deloitte China Research partner, adds, “The vast majority of SMEs are making a pivotal shift into cross-border e-commerce, leveraging platform enterprises, their expansive international service ecosystems and digital technologies.”

Source: Deloitte (Press Release)