- 39% of Singaporeans are worried about retirement inadequacy, with women being at higher risk of retirement inadequacy than men

- 72% of Singaporeans desire higher returns for their investments, but despite that, only 25% are currently investing their CPF

- 31% of Singaporeans have indicated that they would like assistance in the form of tools to help them understand the impact of financial decisions around CPF

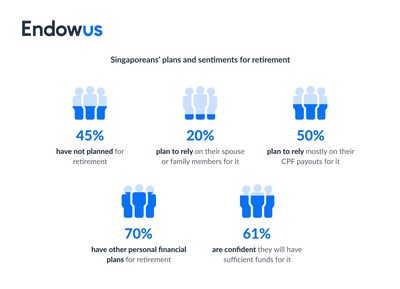

The Endowus Singapore Retirement Report reveals that retirement inadequacy remains a concern for over a third of all Singaporeans, with a significant number having yet to start financial planning aimed at retirement.

Subscribe to our Telegram channel to get a daily dose of business and lifestyle news from NHA – News Hub Asia!

According to the survey, while 1 in 2 Singaporeans are planning to utilise their Central Provident Fund (CPF) monies to fund their retirement, even fewer (25%) have considered supplementing their retirement funds through investing, consistent with CPF Board’s statistics on CPF investment take up rate1. In that, a majority of respondents have indicated the need for additional tools to help them start planning to chart their path to retirement adequacy.

The Endowus Singapore Retirement Report was commissioned by Endowus — one of Singapore’s leading MAS-licensed investment platforms and the first and only digital advisor for CPF investing — with the objective of better understanding Singaporean attitudes towards the generational challenge of retirement and the role that CPF monies play in building a retirement lifestyle that is closer to individual goals.

The Report was commissioned in partnership with YouGov Singapore, with fieldwork for the online survey taking place in May 2021, involving a total sample size of 1099 adults, weighted to be nationally representative of Singapore’s adult population.

The study comes at a time when the financial situations of individuals could be changing due to the economic and social impact of the COVID-19 pandemic and is the first comprehensive study on CPF usage and sentiments since the CPF Advisory Panel’s own study in 2016. The study examined knowledge, intent, behaviours, and motivations around retirement and the role of CPF and CPF investments.

To date, CPF members’ total balance has grown steadily across the years, from $125.8 billion in 2006 to $474.0 billion in March 2021. While it may seem that Singaporeans are planning and saving well for their retirement based on these numbers, only 63.6% of active CPF members who turned 55 were able to set aside their Full Retirement Sum (FRS) or Basic Retirement Sum if they own at least one property in 2020, based on CPF Annual Report 2020.

Singaporeans are worried about retirement adequacy, but only 1 in 4 have taken action

1 in 3 Singaporeans (39%) are worried about retirement inadequacy, with women being at higher risk of retirement inadequacy than men. The study shows that women are half as likely as men to “strongly agree” that they are confident in having sufficient money for retirement. This is especially concerning considering that women live longer with a life expectancy of more than 86 at birth and beyond 88 if they live to 65.

Results from the survey also indicate that 1 in 2 Singaporeans (53%) are planning to use or are currently using CPF to fund their retirement. However, almost half (45%) have not started planning for their retirement, and this is even more apparent in the younger demographic (aged below 35).

Furthermore, lower-income Singaporeans (below $3,000 monthly income) are less likely than higher-income Singaporeans (above $6,000 monthly income) to fund their retirement with CPF, which may drive them to de-prioritise growing and making better use of CPF, lowering their chances of achieving the Full Retirement Sum (FRS) for financial stability at retirement.

Amidst the uncertainty of having adequate CPF savings for retirement, there is also increasing awareness of CPF being used as a retirement safety net. More CPF members are channelling cash to their CPF through the Retirement Sum Topping-Up Scheme (RSTU), where $3 billion was topped up in 2020, up by 39% from 2019, and through the CPF Voluntary Housing Refund Scheme as well, where $1.48 billion was refunded in 2020, up by 189% from 2019. This shows that a growing group of Singaporeans understand that they might be compromising their retirement plans when they use CPF for housing.

Singaporeans lack confidence in CPF investing

A significant majority or 72% of Singaporeans seek higher returns, but despite that, only 25% are currently investing their CPF, even though it is the only way to achieve higher returns on their CPF. This is largely represented in the Gen X (born 1965 to 1980) segment and employed persons with more than $8,000 in household income.

Singaporeans are unsure of whether they should invest their CPF, as shown by the fact that a majority of them (68%) are not confident in investing their own CPF monies well by themselves.

These figures are consistent with the recommendations from CPF Advisory Panel’s findings in 2016. The CPF Investment Scheme (CPFIS) was intended as an option for members to invest and was designed to have a wide menu of investment products that cater to a broad range of investor expertise and experience. The panel concluded that it was not specifically designed to meet the needs of CPF members who wished to invest but feel they lack the financial expertise and/or time and resources to actively manage their investments.

“Endowus was set up to help meet the growing needs of CPF members in receiving better advice in investing and lowering the high costs associated with investing CPF monies that eat away at returns,” says Gregory Van, CEO of Endowus. “We provide investment advice that help CPF members gain exposure to globally diversified portfolios, at the lowest cost possible. We are always working with fund managers to bring in better fund products for our clients, so that they are in a position to achieve higher returns and retirement adequacy.”

The Endowus Singapore Retirement Report also found that Singaporeans ranked higher returns than the CPF interest rates (72%), guaranteed returns (70%), and low costs (45%) as the most important criteria for CPF investing.

Inadequate tools and resources to close the gap on CPF investing knowledge

Due to the complexities and the uncertainties of using CPF around financial decisions, nearly a third of Singaporeans (31%) indicated that they prefer a tool that can help them understand the impact of their financial decisions around their CPF, with a similar number of Singaporeans (28%) indicating that they are keen on a tool that can help estimate retirement income from their CPF.

“With average life expectancy in Singapore now reaching 83.9 years old, CPF will increasingly need to be augmented to provide sufficient income in retirement,” says Samuel Rhee, Chairman and Chief Investment Officer of Endowus. “Considering these shifting time horizons and other uncertainties, more education may be needed to help Singaporeans make better use of their CPF, especially earlier in life, when savers have more time to take advantage of asset growth.”

While it has been reported that 1 in 2 CPF members did not do better than the CPF-OA interest rate of 2.5% for the period of Oct’19 to Sept’20, the Endowus balanced portfolio of global stocks and bonds outperformed the CPF OA interest rate with a return 6.4% during this same period. Our CPF equities portfolios also generated +6.7% returns for Q2’2021, with YTD and 12 month performance at +13.2% and +34.3% respectively.

“As a leading digital wealth management platform, we need to help Singaporeans understand and make smarter financial planning decisions regarding CPF,” added Van.

“Our goal is to meet the needs of Singaporeans and continue to provide clients with an evidence-based approach to their wealth so they can invest better to live easier today and be prepared for the future.”

For more information about the Endowus Singapore Retirement Report 2021, please visit https://endowus.com/insights/singapore-retirement-report-2021/.

SOURCE Endowus (press release)