Continuing a successful partnership with Affin Hwang Asset Management (AHAM), the digital all-in-one savings and investing platform, Versa, is expanding its product range to introduce Versa Invest. The platform offers affordable wealth management to all Malaysians.

Subscribe to our Telegram channel to get a daily dose of business and lifestyle news from NHA – News Hub Asia!

Versa Invest offers three different types of low- to high-risk investment funds — Versa Conservative, Versa Moderate and Versa Growth. Through a pooled investment fund managed by top global fund managers such as Blackrock, PIMCO, Vanguard and HSBC, users are able to diversify their investments across active and passive funds, allowing them to benefit from investment instruments that were once only available to the high net worth individuals.

In lieu of paying excessive sales charges and withdrawal fees at traditional rates, investors can access institutional-grade investment via Versa Invest without having to worry about hidden or additional costs, focusing instead on boosting long-term returns due to having no upfront charges or being three to five per cent down each time an investment is made. At zero entry and exit fees, investors can look forward to earning 100 per cent of what they invest, starting from a minimum investment amount of only RM100.

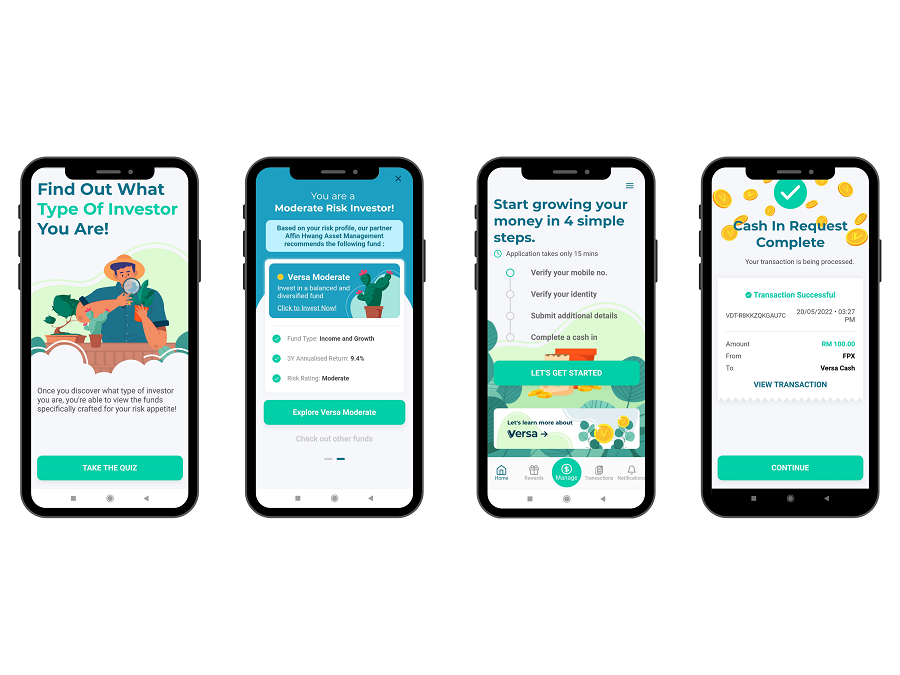

To further enable accessibility, Versa employs an intuitive and sleek interface design that is easy to use even for novice investors.

“Versa’s key product ethos is all about simplicity. Users are able to onboard in under 7 minutes and make a deposit in just three clicks. Versa Invest was designed exclusively only for Versa users to level the playing field allowing for easy access to premium funds by global top fund managers,” explained Richmond Yau, Versa’s Chief Operating Officer.

Versa will be launching two Versa-exclusive funds, aimed to achieve broad diversification whilst minimising risks with the lowest fees possible. Nelson Wong, Chief Technology Officer with Versa explains that “We believe this would be a great option for new investors without the knowledge or desire to continuously watch the market and pick individual funds.”

Meanwhile, the company’s flagship savings product, Versa Cash, a low-risk money market investment fund investment which was launched last year, allows Malaysians to save at higher than fixed deposit rates (2.4 per cent per annum) without any lock-ins. This creates ideal opportunities for users to learn about investing or timing their entry into investing. Versa urges Malaysians to start saving while also learning to invest and to continue in a disciplined and consistent manner over the long run.

With many Malaysians having insufficient savings to invest in their future or even live comfortably, Versa Invest simplifies wealth management through reimagined investments, creating opportunities for individuals to grow their wealth in a manner that is digestible, accessible and above all, safe. Being at the height of digitalisation, Versa Invest enables access to high-quality investment products that the average retail investor would not usually qualify for.

To help you start your investment journey, Versa is offering new customers a signup bonus. Click here for more information.

Source: Versa (Press Release)