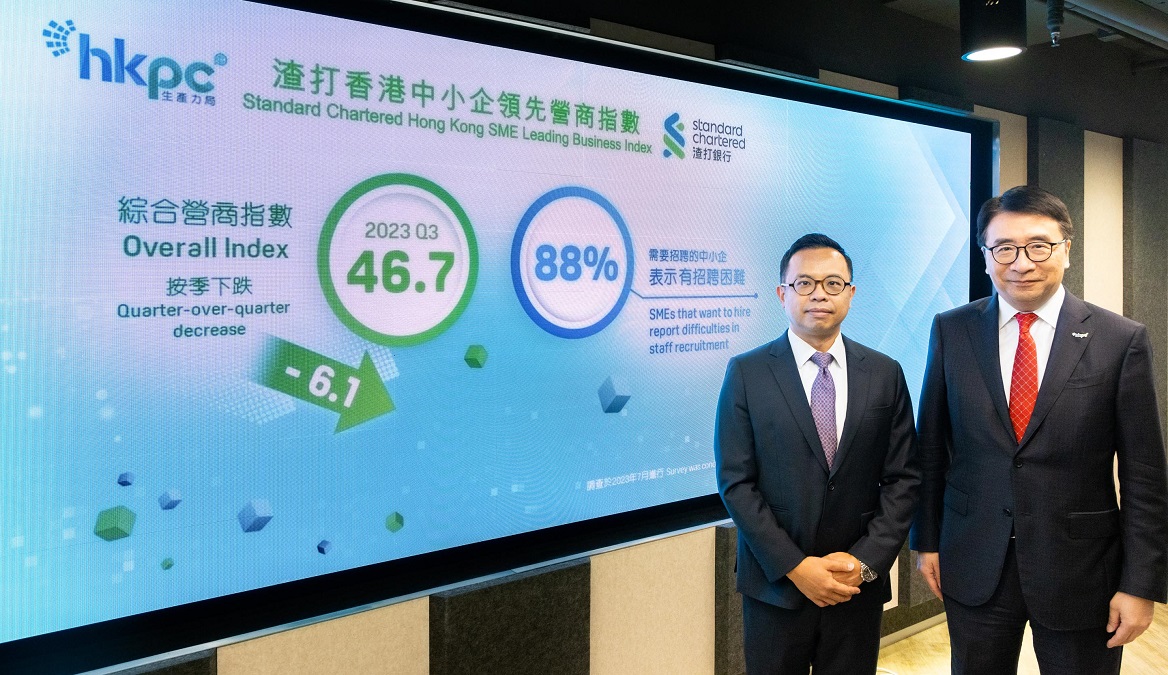

The Hong Kong Productivity Council (HKPC) announced on Thursday the Standard Chartered Hong Kong SME Leading Business Index (Standard Chartered SME Index) for the third quarter of 2023. The Overall Index retreated by 6.1 to 46.7 this quarter, reflecting that the positive effects brought along by the reopening of mainland-Hong Kong’s boundaries are beginning to diminish.

All five component sub-indices1 registered a downfall, with “Business Condition” (44.7, -11.3) and “Profit Margin” (41.5, -9.6) showing the most significant declines, indicating that local SMEs show less confidence in their business turnover for this quarter. “Global Economy” also dipped by 8.0 to 40.3, reflecting that local SMEs are facing challenges from the external environment.

Standard Chartered SME Index Survey Results

All 11 industry indices suffered declines, with “Accommodation and Food Services” (55.4) and “Information and Communications” (49.2) recording the largest drops of 11.8 and 9.7 respectively. Although “Accommodation and Food Services” suffered the largest decline in the index this quarter, it still ranked top among the 11 industry indices. On the other hand, “Transportation, Storage and Courier Services” (39.5) dropped below 40 again.

In terms of overall investment trends, 91 per cent of surveyed SMEs indicated that they would maintain or increase investment this quarter, which is on par with the previous quarter. The areas that most SMEs expected to maintain or increase investment included “Training Related to E-commerce or Digital Technology”, “IT System”, “Research & Development”, “Overall Staff Training”, “Online Marketing Promotion”, and “Offline Marketing Promotion”.

In terms of the changes in cost components, although the proportion of surveyed SMEs expecting an increase in raw material costs in this quarter fell by three percentage points to 67 per cent, the proportion of SMEs expecting an increase in staff salary grew further by two percentage points to 34 per cent, rising by over 10 percentage points from the same quarter last year.

The findings showed that SMEs were still under ongoing pressure from cost hikes. However, only 26 per cent of SMEs expected to increase the price of their product or service, a decrease of four percentage points from the previous quarter, indicating that SMEs have to absorb the increases in costs on their own.

Dr Lawrence Cheung, Chief Innovation Officer of HKPC, said, “After a significant increase in the previous quarter, the index has fallen this quarter, indicating that the short-term positive factors brought along by the return to normalcy have been diminished. In addition, the Manufacturing Purchasing Managers’ Index (PMI)2 of Hong Kong in June also fell, reflecting the growth in the overall order and new export order had narrowed, prompting local SMEs to adopt more conservative business strategies to mitigate risks.

“Furthermore, the uncertainty in the external environment continues to grow. With further tightening of financial conditions and a slowdown in economic growth in advanced economies, the International Monetary Fund has lowered its global economic growth forecast for this year to 2.8 per cent3. Tightening financial conditions will slow down economic growth, causing local SMEs to become more conservative in their business confidence.

“However, despite the declines across all five sub-indices this quarter, both ‘Recruitment Sentiment’ and ‘Investment Sentiment’ stayed above the 50 neutral line, and 91 per cent of the surveyed SMEs indicated that they would maintain or increase their investment this quarter, which is on par with the previous quarter.

“All these reflect SMEs are still positive about the future prospect. It is also worth noting that although ‘Accommodation and Food Services’ suffers the largest drop, it remains above the 50 neutral line and ranks top among the 11 industry indices. This is because the industry expects the rebound in local tourism will continue even after the short-term positive factors have diminished, which will in turn continue to drive economic growth. Therefore, the industry maintains a positive outlook towards the business prospects,” continued Dr Cheung.

Kelvin Lau, Senior Economist, Greater China, Global Research, Standard Chartered Bank (Hong Kong) Limited, said, “A drop in the Overall Index in this quarter following a strong rally of previous quarter was well anticipated, as the boost from prior reopening efforts was bound to fade somewhat. Beyond that, we believe part of the setback in the latest Overall Index could also be due to drags from new economic headwinds, including the rise in uncertainty towards the mainland following its recent string of weak data indicating a softening growth momentum. This is most notable from our ‘Global Economy’ sub-index — its 8.0-point drop to 40.3 was materially lower than the pre-reopening level of 47.0 in the first quarter. Similarly, weak prints for ‘Business Condition’ and ‘Profit Margin’ also indicated a setback to short-term business performance, consistent with the easing in Hong Kong’s recently announced economic growth figures for the second quarter.

Lau added, “All that said, we remain encouraged by the resilience of the ‘Recruitment Sentiment’ and ‘Investment Sentiment’ sub-indices in this quarter. We expect Hong Kong’s unemployment rate to stay low, supporting the outperformance of domestic consumption in the second half of 2023; we also see Hong Kong SMEs’ investment appetite benefiting from the more pro-growth policy support from the mainland authorities on the horizon. We maintain our full-year GDP forecast of 4.3 per cent, which is consistent with a continued modest recovery in the coming quarters.”

Thematic Survey Results

The thematic survey of this quarter explored the recruitment of talent by SMEs. The survey revealed that 29 per cent of the surveyed local SMEs had hiring needs, and 12 per cent of the local SMEs were adding headcounts, with higher proportions found in “Accommodation and Food Services”, “Information and Communications” and “Social and Personal Services”.

In addition, with the labour gap persists, quite a few industries are affected by manpower shortage. The survey also discovered that 88 per cent of SMEs with hiring needs claimed they had encountered recruitment difficulties.

To mitigate the manpower shortage issue, 31 per cent of these SMEs claimed they would consider recruiting non-local talent, 25 per cent would consider using outsourced vendors, and 14 per cent would consider using artificial intelligence (AI) to perform manual tasks. Among those SMEs considering recruiting non-local talent, 90 per cent would consider recruiting talent from the mainland.

The survey also gauged how different talent admission schemes put ahead by the HKSAR Government can help SMEs in talent recruitment. Over half of the surveyed SMEs considering recruiting non-local talent found the “Supplementary Labour Scheme”4 able to help them attract and recruit talent, while 43 per cent considered the “Admission Scheme for Mainland Talents and Professionals”5 helpful.

Dr Cheung continued, “The thematic survey found that most local SMEs are facing a shortage of manpower. Prior to the quarter’s survey, the HKSAR Government announced the newly expanded ‘Talent List’6, which extended the coverage of professions to 51, including development and construction, innovation and technology, financial services, etc.

“Following that, the Government further introduced the enhancement of the coverage and operation of the ‘Supplementary Labour Scheme’ to address acute manpower shortages across various sectors. The market has therefore responded positively as expected, which is reflected in the results of this quarter’s survey.

“Over 30 per cent of SMEs facing recruitment difficulties indicated that they would hire non-local talent to alleviate the impact on daily operations, reflecting their willingness to use the talent admission schemes to mitigate the pressure of manpower shortage,” said Dr Cheung.

Dr Cheung continued, “In addition to utilising Government’s policies to import non-local talent, the survey also found that 14 per cent of SMEs with difficulties in recruitment would consider using AI to perform manual tasks. Being the strongest support for SMEs, HKPC has been providing advanced technology and innovative service offerings to the industry to cope with market challenges, incorporating technologies such as AI, robotics, the Internet of Things (IoT), and big data to encourage enterprises to use technology to replace manpower in handling repetitive processes, allowing employees to focus on other high-value-added tasks, thereby enhancing the competitiveness of the enterprise and its employees in the long run.

“Furthermore, the survey also found that more SMEs plan to maintain or increase investment in ‘IT System’ and ‘Training Related to E-commerce or Digital Technology’. Our ‘Digital DIY Portal’ one-stop platform gathers various commercial digital transformation solutions in the market, solving the problem of early investment in implementing digital transformation and improving operational efficiency. In addition, HKPC Academy also provides a series of FutureSkills courses covering AI, machine learning, and cloud computing, etc. to nurture local talent. In 2022/23, it has provided advanced technology-related training courses for over 6,000 students, equipping talent with FutureSkills to alleviate manpower shortage in the local market,” concluded Dr Cheung.

Conducted in July 2023, the Standard Chartered SME Index Q3 2023 survey successfully interviewed 821 local SMEs. The report will be available for download from HKPC website here.

To learn more about HKPC’s smart solutions to help enhance the productivity of SMEs with advanced technology in achieving Make Smart Smarter, please visit the dedicated webpage: https://smarter.hkpc.org.

References:

1The five sub-indices include “Recruitment Sentiment”, “Investment Sentiment”, “Business Condition”, “Profit Margin” and “Global Economy”.

2Source: Manufacturing purchasing managers’ index (PMI) in Hong Kong from June 2021 to June – 2023

3Source: IMF / World Economic Outlook April 2023 Update

4Under the Supplementary Labour Scheme, employers carrying on businesses in Hong Kong may apply to import workers at technician level or below to fill vacancies for which they have genuine difficulties in recruiting suitable staff locally.

5The objective of the “Admission Scheme for Mainland Talents and Professionals” is to attract qualified mainland talent and professionals to work in the HKSAR in order to meet local manpower needs and enhance HKSAR’s competitiveness in the globalised market.

6Source: https://www.info.gov.hk/gia/general/202306/13/P2023061300538.htm

Source: Hong Kong Productivity Council (HKPC)