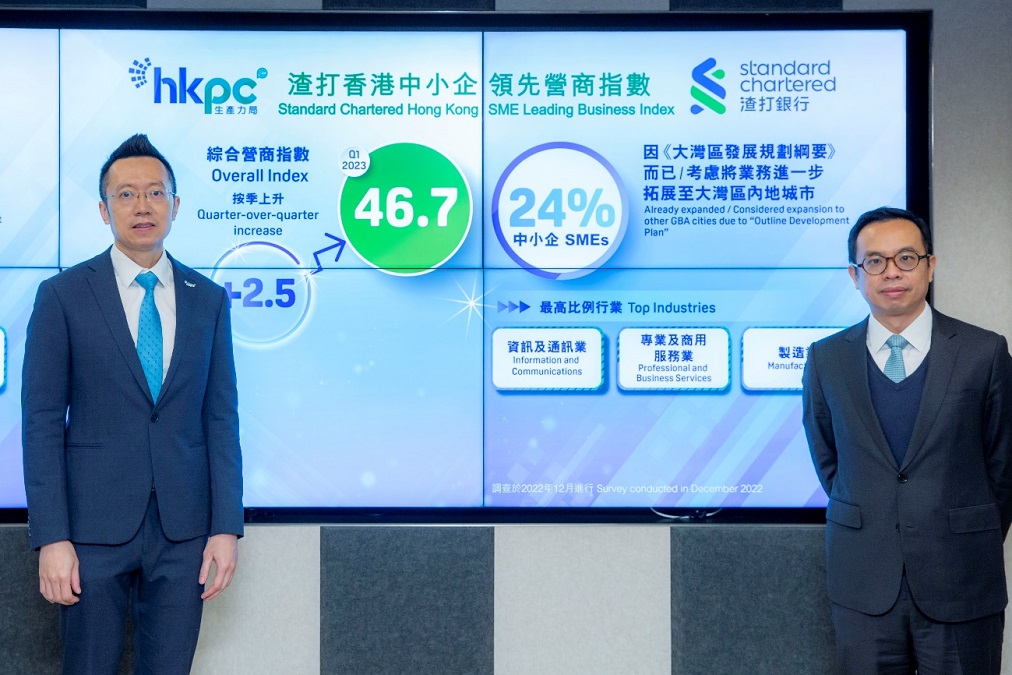

The Hong Kong Productivity Council (HKPC) today announced the “Standard Chartered Hong Kong SME Leading Business Index” (“Standard Chartered SME Index”) for the first quarter of 2023. The Overall Index rebounded by 2.5 to 46.7, reflecting SMEs are seeing rays of hope with gradual boundary reopening and relaxation of the pandemic measures.

Four of the five sub-indices* rose, contributing to this quarter’s rebound. These included “Recruitment Sentiment” (+0.5), “Investment Sentiment” (+1.4), “Business Condition” (+3.2) and, most notably, “Global Economy” (+14.4), among which “Recruitment Sentiment” and “Investment Sentiment” rose above the 50 neutral level.

Subscribe to our Telegram channel to get a daily dose of business and lifestyle news from NHA – News Hub Asia!

Standard Chartered SME Index Survey Results

Among the 11 industry indices, except “Transportation, Storage and Courier Services” (-1.7) and “Accommodation and Food Services” (-0.3) which recorded slight decreases, all the remaining nine recorded increases, including the three major industries, namely “Manufacturing” (+3.1), “Import / Export Trade and Wholesale” (+2.9) and “Retail” (+1.2). Meanwhile, “Financing and Insurance” (+8.3) and “Construction” (+5.5) recorded more notable increases. There were three industries with their industry index surpassing the 50 neutral level in this quarter, namely “Financing and Insurance” (53.2), “Social and Personal Services” (52.9) and “Accommodation and Food Services” (51.6).

In terms of investment trends, 90 per cent of SMEs expected their overall investment to remain or increase in this quarter, with “Social and Personal Services” (94 per cent), “Financing and Insurance” (94 per cent), “Professional and Business Services” (94 per cent) and “Import / Export Trade and Wholesale” (93 per cent) having the highest proportions. In terms of long-term investment, increases of six to 11 per cent points were observed in the proportions of SMEs expecting to remain or increase investment in “Research and Development” (82 per cent), “Facility and Equipment” (82 per cent) and “Office / Factory / Store” (80 per cent).

On the inflation front, 68 per cent of SMEs expected “Raw Material Cost” to increase, with the same proportion as in the last quarter, but 29 per cent expected “Staff Salary” to rise in this quarter, an increase of seven-per-cent-point from last quarter. The top three industries expecting a rise in “Staff Salary” were “Information and Communications” (44 per cent), “Construction” (40 per cent) and “Professional and Business Services” (37 per cent). Under the pressure of surging costs, 31 per cent of SMEs expected to increase their “Product / Service Price” in this quarter, increasing by eight-per-cent-point from the previous quarter.

Mr Edmond LAI, Chief Digital Officer of HKPC, said, “The resumption of a number of international events in the fourth quarter last year was an important milestone towards Hong Kong’s return to normalcy. The fieldwork period of this quarter’s survey also coincided with the Government’s relaxation of pandemic measures and inbound travel control arrangements, and such expected upturn was well-reflected in the index results. With the commencement of the boundary reopening with the Mainland, it is believed that the flow of people between Hong Kong and the Mainland will gradually increase, which will in turn help boost the recovery of the Hong Kong economy. The survey also found that some SMEs expect to increase their investment in this quarter, revealing that the business sector is gradually regaining confidence in investment and preparing for full boundary reopening with the Mainland.”

Mr Kelvin LAU, Senior Economist, Greater China, Global Research, Standard Chartered Bank (Hong Kong) Limited, said, “Our latest survey, having been conducted in the first half of December, allowed us to capture the early positive impacts of the Mainland’s recent exit from stringent pandemic controls on Hong Kong SMEs’ business sentiment. The gradual boundary reopening between Hong Kong and the Mainland and a swift recovery of the Mainland (beyond the short-term pain of more pandemic disruptions) helped boost four of our five main SME sub-indices, and nine out of 11 of its industry indices. It was therefore not a surprise to see that ‘Financing and Insurance’, ‘Social and Personal Services’ and ‘Accommodation and Food Services’ came in with the highest indices, as they are the direct beneficiaries from more cross-boundary activities and international travels. We are also encouraged by the fact that the headline indices of ‘recruitment’ and ‘investment’ – both being more indicative of long-term business confidence as opposed to short-term business performance – stood above the 50 neutral level; this bodes well for the sustainability of Hong Kong’s post-pandemic recovery. We see room for sentiment to improve over the course of 2023 as local/global recovery broadens, allowing the current underperformers in ‘Manufacturing’, ‘Import / Export Trade and Wholesale’ and ‘Real Estate’ to catch up.”

Thematic Survey Results

The thematic survey of this quarter explored the views of Hong Kong SMEs on expanding their business to other Greater Bay Area (GBA) cities. Currently, more than one-tenth (11 per cent) of the surveyed SMEs have already had their sales business in other GBA cities, of which 41 per cent claimed that their turnover in other GBA cities accounted for 50 per cent or more of their total turnover; and 34 per cent claimed that their turnover in other GBA cities accounted for 20-49 per cent of their total turnover. On the other hand, 27 per cent, 13 per cent and six per cent of SMEs have already had procurement, production and outsourcing of professional services or consultancy services in other GBA cities respectively.

24 per cent of the surveyed SMEs claimed to have already expanded/considered expanding their business to other GBA cities or increasing such investment because of the Outline Development Plan for the Guangdong-Hong Kong-Macao Greater Bay Area (“Outline Development Plan”). Among these SMEs, over 70% (72 per cent) would expand their sales business in other GBA cities, while over 40 per cent (44 per cent) would expand their outsourcing of professional services or consultancy services, and 36 per cent would expand on procurement. The three industries with the highest proportion of interest in expanding their business to other GBA cities were “Information and Communications” (56 per cent), “Professional and Business Services” (31 per cent) and “Manufacturing” (29 per cent).

Mr Edmond LAI, Chief Digital Officer of HKPC, continued, “The findings of the survey reflected that Hong Kong SMEs are attracted to expand their business to other GBA cities because of the larger market size, lower costs compared to Hong Kong and other places, and more business partners, suppliers and outsourced service providers. Among Hong Kong SMEs with sales business in other GBA cities, more than 40 per cent mentioned that their turnover in other GBA cities accounted for more than half of their total turnover, revealing the immense business opportunities in other GBA cities. The survey results also indicated that SMEs’ own understanding of local policies, measures and markets is the most decisive factor in determining whether they would develop business in other GBA cities.”

Nonetheless, only 35 per cent of the surveyed SMEs claimed to be aware of the plans or policy measures of the GBA, with higher proportions found in “Manufacturing” (46 per cent), “Financing and Insurance” (44 per cent), “Information and Communications” (38 per cent), “Professional and Business Services” (38 per cent) and “Construction” (38 per cent) industries. Of the various plans or policy measures in the GBA, those most known to SMEs included “Certified Professionals in Hong Kong are allowed to practice in the GBA” (57 per cent), “Tax Concessions” (53 per cent) and “Cross-boundary Wealth Management Connect Scheme” (47 per cent).

The top six challenges SMEs encountered or expected to encounter when expanding their business to other GBA cities included foreign exchange control measures in the Mainland (34 per cent), unfamiliarity with the local laws and regulations (33 per cent), products / services not suitable for other GBA cities (32 per cent), higher investment risks (30 per cent), differences in customer needs between Hong Kong and other GBA cities (26 per cent) and unfamiliarity with the local taxation system (25 per cent).

Mr LAI added, “The gradual resumption of quarantine-free travel between Hong Kong and the Mainland since early January has helped boost economic activities and personnel exchanges between Hong Kong and the Mainland. Coupled with the gradual recovery of the Mainland, it is expected that the GDP of the Mainland will grow rapidly this year, providing a favourable business environment and conditions for Hong Kong SMEs to expand into other GBA cities. HKPC has joined hands with the China Association of Productivity Promotion Centers, Guangdong Productivity Promotion Center and Macau Productivity and Technology Transfer Center to establish the ‘Guangdong-Hong Kong-Macao Greater Bay Area Productivity Promotion Service Alliance’, to provide the most appropriate local industry information and technical experience to enhance the productivity and competitiveness of SMEs.”

“The thematic survey also revealed that unfamiliarity with local regulations and differences in customer needs between Hong Kong and other GBA cities etc., are challenges for SMEs to invest in other GBA cities. In view of this, our ‘Bay Area Forum’ will continue to organise a series of thematic seminars regularly and invite representatives from the local governments and industry experts to introduce the industrial environment and economic situation as well as the latest support packages to enterprises. It is believed that as more businesses are aware of the publicity efforts and policy plans for the development of industries in other GBA cities, more Hong Kong SMEs will be able to expand into the local market and grasp the various business opportunities arising from the development of other GBA cities, thereby promoting economic integration and synergy in the GBA,” concluded Mr LAI.

Conducted in the first half of December 2022, the Standard Chartered SME Index survey successfully interviewed 822 local SMEs. The report will be available for download from the HKPC website later.

To learn more about HKPC’s smart solutions to help enhance the productivity of SMEs with advanced technology in achieving Make Smart Smarter, please visit the dedicated webpage.

*The five sub-indices include “Recruitment Sentiment”, “Investment Sentiment”, “Business Condition”, “Profit Margin” and “Global Economy”.

Source: HKPC