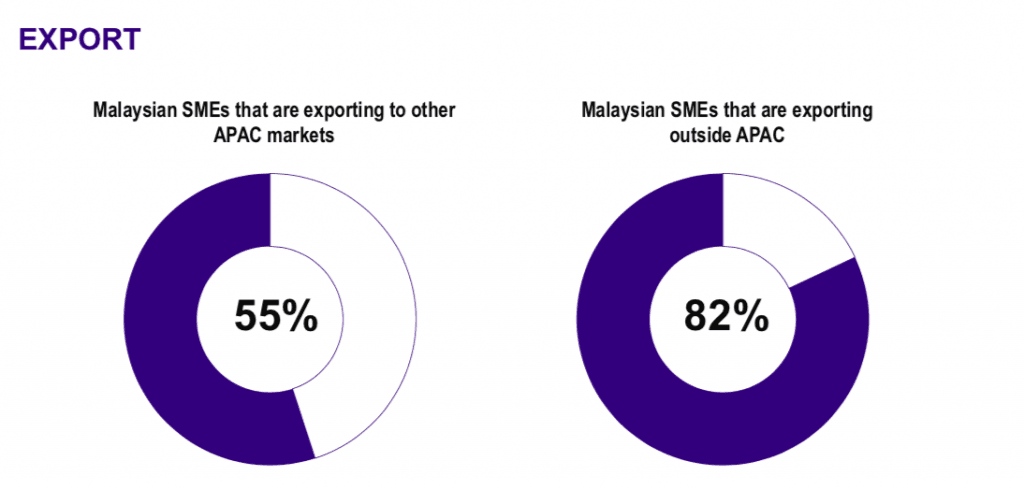

SELANGOR, January, 2019 — Research recently commissioned by FedEx Express, a subsidiary of FedEx Corp. (NYSE: FDX) and the world’s largest express transportation company, reveals that most Malaysian SMEs who export are focusing on markets beyond the Asia Pacific (APAC) region. Notably, 82% of these Malaysian SMEs are now exporting to markets beyond APAC, which by far exceeds the 55% exporting within APAC.

Building upon its findings in 2016 from SMEs in nine APAC markets, the 2018 research, entitled “Global is the New Local: The Changing International Trade Patterns of Small Businesses in Asia Pacific,” reports that exports now make up 71% of the revenues of APAC SMEs who export. This has increased by 60% since 2016, showing that these APAC SMEs are tapping into international markets to grow their business. The study also shows that for the first time, exports from APAC SMEs to markets outside of APAC have exceeded exports to markets within the region. Specifically, 71% of APAC SMEs who export are now exporting globally beyond APAC while 70% export within the region.

“It is exciting to see that local SMEs are taking the opportunity to expand their businesses globally and generate more revenues from exports. At FedEx, we believe a connected world creates significant possibilities, and cross-border trade helps businesses, and ultimately economies and communities benefit and grow in an increasingly globalised market,” said S.C. Chong, managing director, FedEx Express, Malaysia. “This trend is the result of SMEs having ever-increasing access to the right resources such as new technologies, logistic solutions, and developmental aid that help empower them to broaden participation in the global market.”

Welcoming the findings, Dato’ Ng Wan Peng, COO, Malaysia Digital Economy Corporation (MDEC) commented: “Today’s hyper-connected and eCommerce fuelled global market is more accessible than ever with endless possibilities for businesses that take the leap to expand their businesses digitally. MDEC will continue to support SMEs through various strategic platforms, as well as provide comprehensive training and the development of technical skills to help them to propel forwards into the future. Coupled with the government’s continued commitment to equip our local SMEs with state-of-the-art infrastructure and tools for cross-border trade such as the Digital Free Trade Zone (DFTZ), SMEs are encouraged to the giant leap to enhance relevancy in today’s technology-infused economy.”

Malaysian SMEs among the top 4 SME export markets in APAC

According to the research, exports also account for 77% of the total revenues of SMEs, with Malaysian SMEs earning RM4.75 million annually, ranking them among the top 4 SME export markets in the Asia Pacific region in terms of revenue, behind Singapore (RM7.18 million), Hong Kong (RM5.93 million), and the Philippines (RM5.79 million).

China and Thailand are the top export markets for local SMEs in the Asia-Pacific region with 29% of SMEs exporting to those two markets. On the other hand, India and Bangladesh are the top export markets outside the Asia-Pacific region at 48% and 20% respectively.

Sourcing of goods and services locally

More than half of Malaysian SMEs (57%) source goods and services such as raw materials, components, finished products, professional services and designs from within the country while 43% import them from other markets. However, 37% of local SMEs predict an increase in imports in the near future, citing higher quality products, lower production cost, greater product variety, higher customer satisfaction and increased sales as the main advantages of importing.

The independent study, entitled “Global is the New Local: The Changing International Trade Patterns of Small Businesses in Asia Pacific”, was conducted by Harris Interactive on behalf of FedEx Express to offer insights into import and export opportunities and challenges facing SMEs. The results are based on interviews with 4,543 senior executives of SMEs conducted online or by telephone in nine markets in Asia Pacific between March and April 2018. The markets included in the research were Mainland China, Hong Kong, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan and Vietnam. Interviews were split equally by market with a representative mix of company sizes: micro (1-9 full-time employees), small (10-49 full-time employees) and medium (50-249 full-time employees). The sample size was approximately 500 respondents per market.