By Property360Digest – Gunaprasath Bupalan

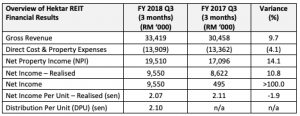

Kuala Lumpur, November 27, 2018 – Hektar Asset Management Sdn. Bhd., the Manager of Hektar Real Estate Investment Trust (“Hektar REIT”) announced that Hektar REIT recorded a higher revenue of RM33.4 million for the third quarter ended September 30, 2018 (“3Q18”), up 10% from the corresponding period(“3Q17”). Its Net Property Income (“NPI”) reached RM19.5 million, an increase of 14% for 3Q18 from the preceding year quarter, 3Q17.

“Hektar REIT’s fundamentals remain strong with a solid track record for occupancy, y-o-y increase in revenues and also higher net property income. Our performance this quarter is driven by stronger leasing performance as represented by positive rental reversions of 7.9% year-to-date. We are committed to continue to bring in tenants with proven business model and track record to ensure that we remain relevant to the communities they serve,” said Chief Executive Officer, Dato’ Hisham bin Othman.

Hektar REIT declared a third interim distribution per unit (“DPU”) of 2.10 sen. Based on the closing price of RM1.24 on September 28, 2018, the annualised DPU for the year represented a distribution yield of approximately 7.2%. Hektar REIT maintains a distribution policy of at least 90% of distributable net income, which typically excludes items such as capital allowances and revenue arising from Financial Reporting Standards 117, an accounting standard. The Book Closing Date is on December 14, 2018 and payment of the distribution will be made on January 3, 2019.

During the three months period under review, there were 38 new and renewed tenancies on over 180,000 square feet, representing 8.9% of Hektar REIT’s Net Lettable Area (NLA) within its overall portfolio. This quarter saw a positive reversion of 7.9% for the portfolio. “Year-to-date, the overall portfolio has managed to achieve a healthy rental reversion of 7.6%, through 113 new and renewed tenancies on over 426,000 square feet of NLA. We look forward to the improved results in Segamat Central after the introduction of new anchor and mini anchor tenants, TF Value Mart and MR DIY”, said Dato’ Hisham.

The portfolio demonstrated stability, with approximately 10.8% increase in Realised Income compared to the preceding year quarter.Comparing the 9 months period ending September 30, 2018 set against the same period in 2017, the results showed consistency as year-to-date Realised Income for Hektar REIT is 6.8% higher and its NPI is 10.6% higher than the previous year.

Hektar REIT’s portfolio consists of mostly neighbourhood shopping centres, which in general are more resilient and defensibleduring economic downturns. Hektar REIT’s total portfolio has a combined net lettable area of 2.0 million square feet and has a healthy 91.6% overall occupancy. Hektar REIT’s portfolio of six shopping malls include Subang Parade in Subang Jaya, (Selangor); Mahkota Parade in Melaka; Wetex Parade in Muar (Johor); Central Square in Sungai Petani (Kedah); Kulim Central in Kulim (Kedah) and Segamat Central in Segamat (Johor). The portfolio’s catchment serves a market size of 3.0 million shoppers.

For further information, please log on to www.bursamalaysia.com